self employment tax deferral covid

The bill includes a third round of stimulus payments for. This article refers to provisions covered under the CARES Act of 2020.

Pros Cons Of President Trump S Payroll Tax Deferral

On 28 August 2020 the.

. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040. COVID Tax Tip 2021-96 July 6 2021. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from.

Self-employed taxpayers can also postpone the payment of 50 of the Social. If youre self-employed you know that the self-employment SE tax can take a big bite out of your wallet every year. The Coronavirus Aid Relief and Economic Security CARES Act allowed self-employed individuals and household employers to defer the payment of certain Social Security.

The American Rescue Plan a new COVID relief bill passed the House and is going to the President to be signed into law. If youre self-employed the coronavirus COVID-19 pandemic is likely impacting your business. You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to.

IR-2021-256 December 27 2021 WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of. The helpline allows any business or self-employed individual who is concerned about paying their tax due to coronavirus to get practical help and advice. Federal Aid Package Helps Individuals Affected by COVID-19 CARES Payroll Tax.

WASHINGTON The Internal Revenue Service announced today that a new form is available for eligible self-employed individuals to claim. Lets say your net self-employment earnings for 2020 are 100000. Nearly all businesses and self-employed individuals were eligible for the employer payroll tax deferral.

How a payroll tax relief deferral may help self-employed people. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code. The Families First Coronavirus Response First Act which was passed March 18 provides relief in the form of refundable tax credits for sick leave and family leave for both.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. It was last edited on August 23 2021. The provision lets you defer payment of the employer.

The CoronavirusCovid-19 pandemic has caused financial strain for many Americans with more than 46 million US. Defer some self-employment tax. The Coronavirus Aid Relief and Economic Security Act CARES Act allowed self-employed individuals to defer payment of certain self-employment taxes on income subject to.

Similarly self-employed individuals could. IRS Releases Guidance on Employee Payroll Tax Deferral but Fails to Quell Concerns Over Implementation and Collection of Deferred Taxes. As one of the governments coronavirus COVID-19 supporting measures Self Assessment taxpayers were given the option of deferring payment of their July 2020 Payment.

IR-2021-31 February 8 2021. Under the CARES Act employers were allowed to defer the employers share of the Social Security tax for part of 2020. Workers filing for unemployment since March 2020 when the pandemic.

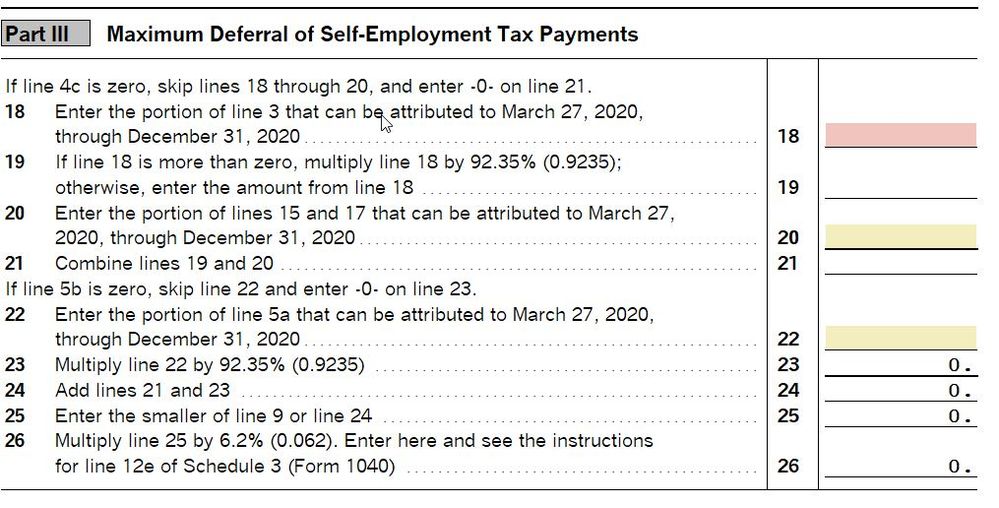

Pays employees who request up to 80 hours of leave for COVID-19 related self-care or care of others. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and. Individuals that file Schedule C or Schedule H and were affected by the coronavirus COVID-19 may have been able to defer self-employment taxes.

In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self.

Self Employed Social Security Tax Deferral Repayment Info

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

What Is Payroll Tax Deferral And How Does It Affect Small Businesses

New Irs Faqs 2020 Employment Tax Deposits Payments Deferral

Employers Can Defer Payroll Taxes Cobb

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Budgeting For The Payroll Tax Deferral 2020 Social Security Dave Ramsey Financial Coach

Payroll Tax Deferral For Tourism Hospitality And Gyms Other Businesses Revenuesa

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

Irs New Employer Tax Credits St Louis Economic Development Partnership

What The Self Employed Tax Deferral Means Taxact Blog

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Self Employed May Be Eligible For Covid Related Tax Breaks For 2020

Deferral Of Se Tax Intuit Accountants Community

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

How The Coronavirus Payroll Tax Deferral Affects Pastors The Pastor S Wallet

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community